Bitcoin SV (BSV) Future: Distance of the decentralized cryptocurrency potential

In the cryptocurrency world, only a few words have gained as much attention and fame as Bitcoin. Another remarkable player in space is Bitcoin Satoshi (BSV), also known as Bitcoin St. Since the popularity of BSV continues to grow, many investors and dealers think about what it means for their portfolios and how they navigate quickly changing landscape can.

What is Bitcoin SV?

Bitcoin Satoshi is an open source blockchain software that was created by Nick Szabo in 2008. In 2017, Bitcoin Blockchain crumant was first, with the aim of creating a more decentralized and more flexible alternative to conventional cryptocurrencies such as Bitcoin. The BSV network has several important functions that make it attractive to dealers:

- Decentralized management : In contrast to many other cryptocurrencies, BSV works with a decentralized management model. This means that no unit controls the network or makes decisions for its users.

- Twinchain : BSV is a protocol from Twinchain, which enables seamless trade between BSV and Bitcoin (BTC). This integration offers dealers access to a wider market and more efficient transactions.

3

Smart Contracts

: The BSV network uses intelligent contracts that represent contracts with the conditions of the contract that was written directly in the ranks of the code.

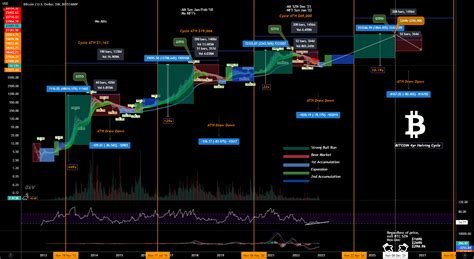

BSV increases

In recent years, BSV has experienced significant growth, which is made easier by its introduction in various sectors such as games, finance and health care. According to CoinmarketCAP, the overall market capitalization of all BSV -related assets exceeds $ 1 billion US dollars, which makes it one of the fastest growing cryptocurrencies on the market.

Why Bitcoin SV is a convincing choice for dealers

Several factors make BSV an attractive opportunity for investors:

1

High liquidity : The BSV network has a high sales volume that offers more flexibility and options for users when buying or selling.

- Low fees : Compared to other cryptocurrencies, the BSV transaction fee is relatively low, which makes it an attractive choice for dealers who prioritize efficiency compared to price volatility.

3

Regulatory clarity : Since the BSV is formed over the Twinchain protocol, which was developed, taking into account compliance with the official decreases, investors can be sure that there will be clear guidelines and rules for its use.

Challenges and restrictions

While BSV has taken considerable steps in recent years, it still faces various challenges:

- scalability : When the network grows, its scalability can become a problem, especially when working with a large amount of transactions.

- Adoption : While BSV is traction, it still remains behind other cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH), whereby the main acceptance is taken into account.

3

Safety

: As with any decentralized system, there is a risk of security or use in the BSV network.

Diploma

Bitcoin Satoshi’s growth in note was not impressive, relieved by its innovative management model, seamless integration into other cryptocurrencies and increasing acceptance in various sectors. While this faces challenges such as scalability and regulatory clarity, BSV is still an attractive opportunity for dealers who are looking for a decentralized alternative to traditional cryptocurrencies.

While the BSV network develops and grows, investors will probably see more opportunities in this room that will show more options. Regardless of whether you are an experienced dealer or are just starting a job, it is important to carry out your research and before you invest in BSV or other cryptocurrency, take your risk tolerance into account.

Liability exclusion : This article only serves for information purposes and should not be viewed as an investment in tips.