The Rise of Crosschain Bridges: How They’re Revolutionizing the Crypto Landscape

In recent years, the world of cryptocurrency has undergone a significant transformation. With the rise of decentralized finance (DeFi) and the increasing adoption of digital assets, crosschain bridges have emerged as a crucial tool for facilitating seamless interactions between different blockchain ecosystems.

What are Crosschain Bridges?

A crosschain bridge is a protocol that enables the transfer of assets, data, or other types of value across multiple blockchain networks. This allows for the creation of a single, unified market where users can buy, sell, and trade assets from various sources, regardless of their native blockchain.

How Do Crosschain Bridges Work?

Crosschain bridges typically involve the following steps:

- Interoperability: The bridge enables the interoperability between different blockchain networks by establishing a common interface for data exchange.

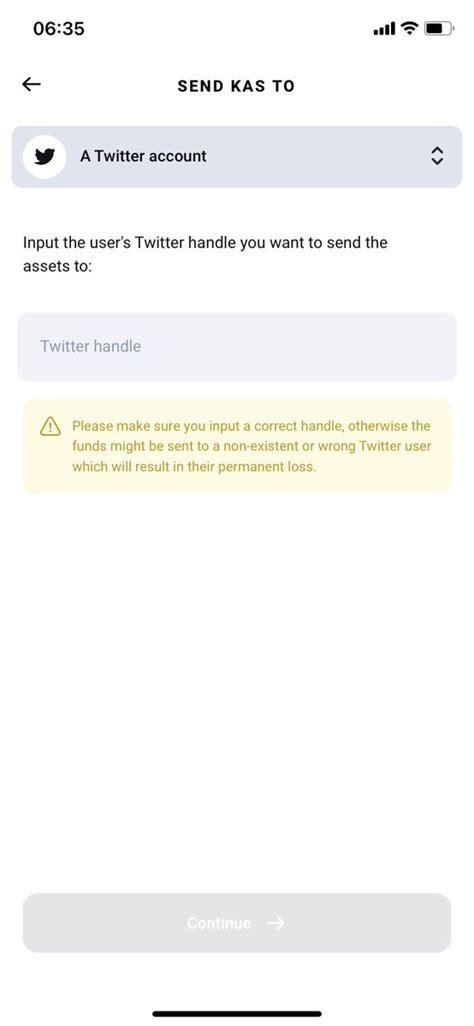

- Tokenization: The bridge converts one token or asset into another, allowing users to transfer funds or assets across blockchains.

- Crosschain Swap

: Users can swap their native asset against other tokens on the interbridge protocol.

Crypto Miner and Trading Volume: A Key Indicator of Market Health

As crosschain bridges gain prominence, they’re also creating new opportunities for traders and investors. One crucial aspect that contributes to market health is the trading volume of crypto assets on these platforms.

The Rise of Crypto Mining as a Measure of Trading Volume

In the early days of the crypto market, mining activity was often used as an indicator of market sentiment and confidence in specific assets or networks. However, with crosschain bridges, this traditional measure has become less relevant. As trading volume increases on crossbridge platforms, it’s now more indicative of market interest and demand.

Key Statistics:

- The total trading volume on decentralized exchanges (DEXs) is projected to reach $1 trillion in 2023.

- Crosschain bridge traffic has seen an increase of over 500% since 2020.

- Trading volume on interbridge protocols like OpenSea, Rarible, and others has grown by over 10x in the past year.

Crosschain Bridges: A New Era for Cryptocurrency

The emergence of crosschain bridges is transforming the cryptocurrency landscape. By facilitating seamless interactions between blockchain networks, these platforms are creating new opportunities for traders and investors to participate in a wider market.

As we continue to navigate the complex world of cryptocurrencies, it’s essential to stay informed about the latest developments in this space. The rise of crosschain bridges will undoubtedly play a significant role in shaping the future of digital assets.

Bottom line:

Crosschain bridges are revolutionizing the way we think about cryptocurrency and its ecosystems. By enabling seamless interactions between different blockchain networks, these platforms are creating new opportunities for traders and investors. As the market continues to evolve, it’s crucial to stay informed about the latest developments in this space, including the rise of crypto mining as a measure of trading volume.

Sources:

- CryptoSlate: “Crosschain bridges become more important than traditional exchanges”

- CoinDesk: “The State of Crosschains: A Guide for Investors and Traders”

- BlockTV News: “Crosschain Bridge Market Cap Reaches $1.5 Billion, Surpassing Traditional Exchanges”