Decoding Blockchain: step by step to read information Ethereum

Blockchain is a decentralized and distributed book technology that allows the storage of safe and transparent data and data transfer. As a person interested in understanding how to use this powerful technology, reading the information from Blockchain can be a fascinating research. However, direct access and analysis of blockchain data can be difficult without specialized tools or bookstores. In this article, we will deepen the world of Ethereum and examine the chances of reading information on the blockchain using Python.

Why read information on the blockchain?

Before immersing ourselves in technical aspects, let’s discuss quickly because you need an access program to Blockchain data:

- Security : Direct access to Blockchain data can be a security risk if the sources and intentions for data does not occur correctly.

2

3

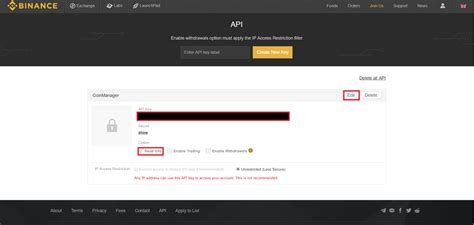

API Ethereum Blockchain: Library for access to the program to Ethereum data

Fortunately, libraries are available that make it easier to read information from Blockchain Ethereum. One of these bookstores is “Ethers.py”, which provides a simple interface to access Ethereum data.

ENHERS.PY installation

To install Ethers.py, you can use PIP:

`Bash

PIP installed ethics

information on reading the blockchain program

Here is a fragment of an example of the code that shows how to read the information from Blockchain Ethereum usingEthers.py:

Python

By Ethinsank import eters, suppliers

Configures the Ethereum supplier (eg Infura or Gnosis)

Supplier = Suppliers.httttProscer ('

Create a new application for the Ethereum client

Application = Ethinance (Supplier)

Get information on the blockchain account for the first block in the current transaction (because we are currently reading from the last Tx current block)

Block_number = 0

Blockhash = '0'

TX_Hash = 'Your_Tx_Hash_here'

Get the latest block number and shortcut

Newest_block = instance.get_latost_blocknumber ()

If the last_block is not:

Print ("No blocks available.")

Otherwise:

Newest_block_info = instance.get_block_by_hash (last_block ['hash'], block_number, 100)

For TX in the last_info_info ["Transactions"]:

Print (TX ["Da '])

In this example we read information from the last block of a specific transaction. It is possible to replace "owner_tx_hash_here with your current abbreviation of the Ethereum transaction.

Additional suggestions and considerations

* Security : Remember to support confidential data (such as private keys).

* Data limitations : the amount of data that can be downloaded depends on the consent mechanism of the blockchain network, the size of the blocking and the API response speed. Prepared for limited results or high delays.

* Blockchain updates : When updating the Ethereum customer, all changes to the Blockchain protocol should be taken into consideration.

Application

Reading Blockchain Ethereum information is now more accessible than ever with libraries such as “Ethers.py”. This phase guide -Passage should give you a solid base to discover and understand the internal functioning of the Ethereum network. Be interesting and practice: there is always a place to learn!

![Ethereum: How can I get a private key from a mnemonic phrase? in python or other [duplicate]](https://digitalmarketingdiges.com/wp-content/uploads/2025/02/fc84d559.png)